Market Pulse - Eco-economic Considerations for the Week Ahead

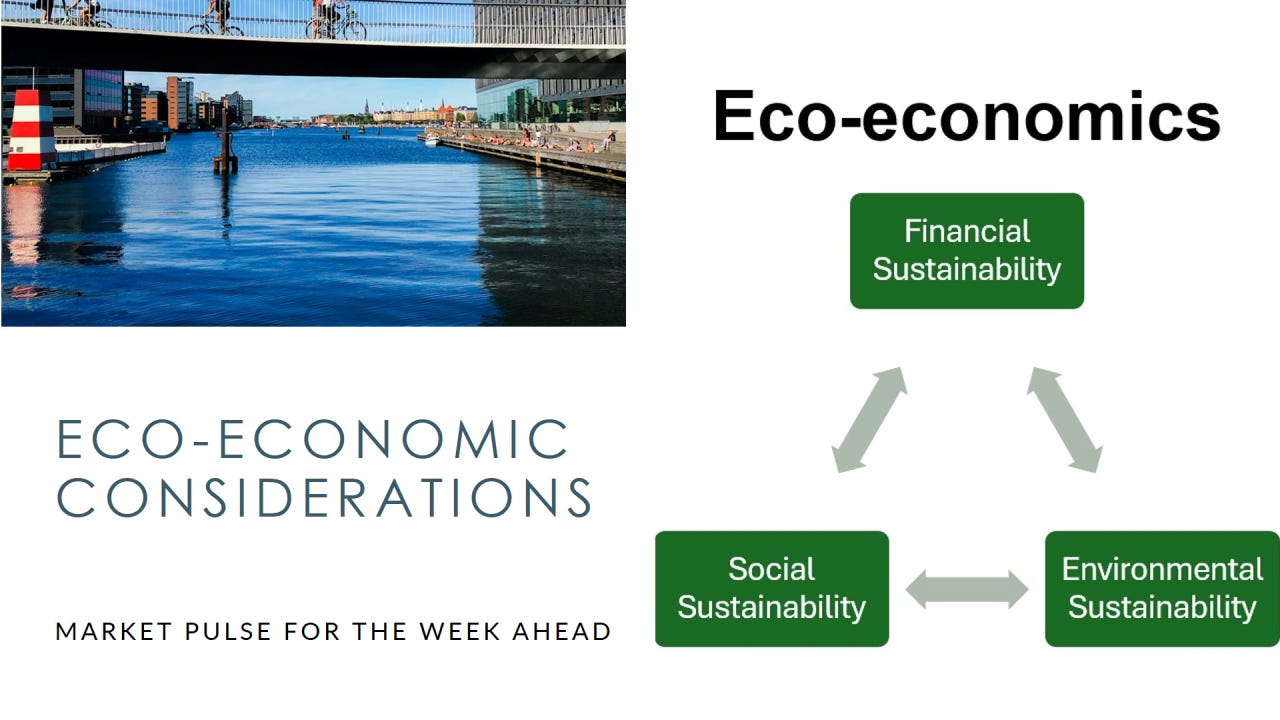

As we move into another eventful trading week, it’s essential to examine the interplay between economic indicators, market trends, and the broader societal and environmental implications. This post covers last week’s market performance, upcoming macroeconomic developments, key earnings reports, and reflections on financial, social, and environmental sustainability. Let’s dive in.

Macroeconomic Developments to Watch

This week brings several pivotal macroeconomic updates that could influence global markets:

Inflation Data: U.S. CPI figures for December 2024 will be released midweek. Investors anticipate a clearer picture of inflationary pressures and the Federal Reserve's next policy moves.

China’s Trade Data: A report detailing export and import performance in December will provide insights into the health of the global supply chain and demand recovery.

Central Bank Activity: The European Central Bank is expected to announce its rate decision, with markets bracing for either a continuation or a pause in rate hikes.

U.S. Retail Sales: Insights into consumer spending trends during the holiday season will be unveiled.

Each of these developments could shift market sentiment, impacting equities and fixed income globally.

Market Performance Last Week

Global markets delivered lackluster performance, influenced by several key factors:

Rising Treasury Yields: U.S. Treasury yields climbed, with the 10-year note hitting 4.77%, creating concerns about higher borrowing costs and potential headwinds for corporate profits.

Geopolitical Tensions: Uncertainty around U.S.-China relations and reports of China suspending imports of U.S. agricultural products dampened investor sentiment.

Mixed Economic Data: Weak retail sales from the U.S. raised questions about the strength of the consumer-led recovery.

Major indices saw declines:

S&P 500: Down 1.55%, closing at 580.49.

Dow Jones Industrial Average: Fell 1.61%, closing at 419.33.

Nasdaq Composite: Dropped 1.56%, finishing at 507.19.

Key Earnings Releases: Last Week’s Highlights

Delta Air Lines (DAL)

Delta reported a stellar quarter, with adjusted EPS rising 44.5% year-over-year to $1.85, exceeding consensus estimates. Revenue grew to $15.56 billion, reflecting strong demand for air travel. Delta’s optimistic guidance for 2025 includes expected EPS growth of over 10% and free cash flow exceeding $4 billion. This performance underscores the importance of efficient logistics in enhancing economic sustainability while addressing emissions in aviation.

Walgreens Boots Alliance (WBA)

Walgreens delivered better-than-expected results, with sales reaching $39.46 billion, up 7.5% year-over-year. Adjusted EPS came in at $0.51, beating estimates. The company maintained its annual guidance, reflecting confidence in its turnaround strategy. Walgreens’ focus on healthcare access and retail innovation emphasizes the social dimension of sustainability by addressing community health disparities.

Earnings to Watch This Week

Several influential companies are scheduled to release their earnings:

JPMorgan Chase, Citigroup, and Goldman Sachs: Banking heavyweights report midweek, providing insights into financial sector health.

UnitedHealth Group (UNH): A key indicator for the healthcare sector, reflecting both financial and social trends.

Tesla (TSLA): Investors will focus on delivery numbers and guidance as a proxy for advancements in sustainable transportation.

Summary of Last Week’s Posts

Market Pulse - Jan 6th, 2025

In last week’s Market Pulse, we observed a mixed performance across U.S. markets, with the S&P 500 gaining 1.23% and the Nasdaq outperforming with a 1.64% rise. Key highlights included geopolitical developments and their influence on currency markets, as well as a focus on eco-economic considerations shaping investor strategies. The week’s data and earnings releases underscored the growing importance of integrating sustainability into financial analysis.

Booking Holdings Inc. (BKNG)

Our deep dive into Booking Holdings highlighted the company’s robust business model and strong financial performance, with Q3 2024 revenue up 9% year-over-year to $8 billion. The post emphasized the company’s alignment with eco-economic principles through its initiatives in alternative accommodations and digital solutions to reduce travel’s environmental footprint. Booking’s strategic focus on AI and its competitive edge in the travel sector further reinforce its leadership position in promoting sustainable growth.

Connecting Financial, Social, and Environmental Sustainability

Last week, we explored how companies like Booking Holdings and Walgreens are integrating sustainability into their operations. Booking’s emphasis on empowering small property owners and Walgreens’ focus on healthcare access showcase how social initiatives can complement financial goals. Delta’s fleet modernization efforts highlight the interplay between operational efficiency and environmental stewardship. These examples underscore the triangular relationship between financial stability, societal well-being, and environmental preservation.

Final Thoughts

The week ahead promises critical developments across macroeconomic and corporate fronts. From inflation data to pivotal earnings reports, these events will shape market trajectories. As investors, we must continue to evaluate how financial outcomes align with broader societal and environmental imperatives.

Stay tuned for deeper analyses and actionable insights as we navigate this dynamic landscape.