Procter & Gamble: Steady Growth Amid Global Challenges

As we look at Procter & Gamble's latest performance in the first quarter of fiscal year 2025, we see a company that continues to demonstrate why it's a cornerstone of many investment portfolios. PG is part of the Helix Transition Index, and here, I take you through how they fit into the Eco-economics triangle.

Strong Financial Performance Continues

The numbers tell a compelling story. P&G achieved 2% organic sales growth, with an impressive eight out of ten product categories showing positive growth. More importantly, the company's core earnings per share grew by 5% to reach $1.93, while operating margins expanded to 26.7%. These aren't just numbers on a page - they represent P&G's ability to maintain profitability even as market conditions evolve.

What makes these results particularly noteworthy is that they've been achieved during a period of significant global economic uncertainty. The company generated $4.3 billion in operating cash flow, maintaining a healthy adjusted free cash flow productivity of 82%. This strong cash generation allows P&G to continue investing in its future while rewarding shareholders through dividends and share repurchases.

Market Leadership and Innovation

P&G's market position remains formidable. The company has grown its global aggregate value share by 10 basis points, with 28 of its top 50 category/country combinations either maintaining or growing their market share. This success stems from P&G's strategic focus on premium products and continuous innovation.

However, no company is without challenges. The Beauty segment, particularly the SK-II brand, has seen some decline. Yet, other segments like Grooming and Home Care have shown strong performance, with share increases of 0.9 and 0.6 points respectively. This mixed performance across segments demonstrates the advantage of P&G's diversified portfolio approach.

Triangular Relationship Between Financial, Environmental and Social Sustainability

P&G isn't just focused on financial metrics. Through its Ambition 2030 program, the company continues to push forward with environmental initiatives across its operations. This commitment comes with real challenges - the company faces a $200 million commodity cost headwind for fiscal 2025. Rather than backing away from sustainability commitments, P&G is working to optimize its environmental impact while maintaining operational excellence.

The company has also shown pragmatic management of challenging market conditions, particularly in Argentina and Nigeria, where it has undertaken limited market portfolio restructuring. While this resulted in approximately $0.8 billion in after-tax charges, primarily from currency translation losses, it demonstrates P&G's ability to make tough decisions while maintaining its commitment to responsible business practices.

PG is among a handful of companies that are able to manage this triangular relationship, through the market adoption of its products and services.

Looking Ahead

P&G's management team remains confident in the company's trajectory, maintaining its fiscal 2025 guidance for organic sales growth of 3-5% and core EPS growth of 5-7%. This confidence is backed by concrete plans, including approximately $10 billion in planned dividend payments and $6-7 billion in share repurchases for fiscal 2025.

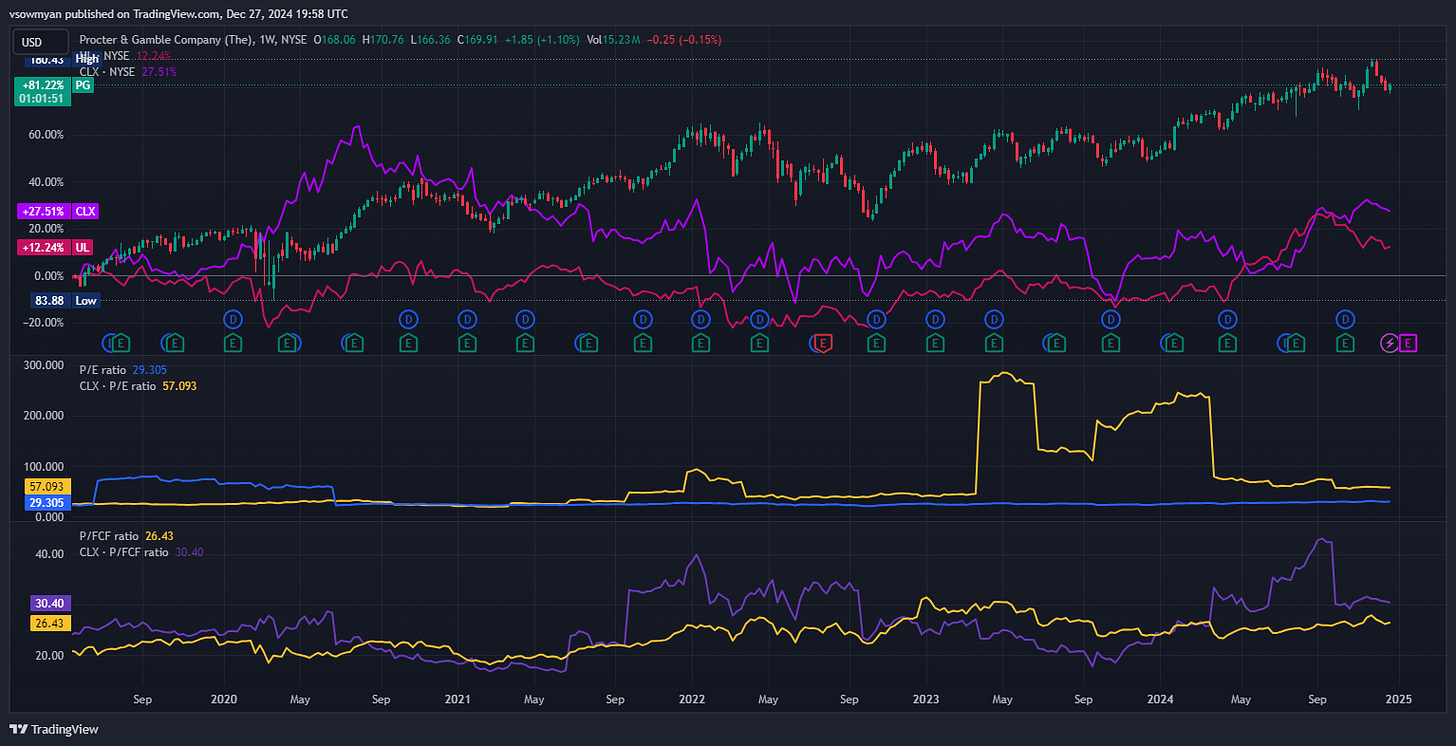

The company's strategic execution and financial stability make it an interesting candidate for sustainability-focused portfolios. When compared to competitors like CLX and UL over the past four years, P&G has shown superior performance with an 81.22% growth rate, significantly outpacing its peers' returns of 27.51% and 12.24% respectively.

Final Thoughts

P&G's latest results reinforce its position as a resilient player in the consumer goods sector. While the company faces challenges in certain markets and segments, its balanced approach to financial performance, environmental initiatives, and social responsibility creates a compelling investment case. For those interested in companies that combine strong financial performance with meaningful sustainability initiatives, P&G's recent performance and strategic direction warrant attention.

The projected core earnings per share of $6.91 to $7.05 for fiscal 2025 suggests steady growth ahead, and the company's proven ability to navigate market complexities while advancing sustainability goals positions it well for the future. As always, investors should conduct their own research and consider their specific investment objectives, but P&G's recent performance provides plenty of food for thought.

Detailed investment research report, available below the paywall.

Keep reading with a 7-day free trial

Subscribe to Helix, by Sowmy VJ to keep reading this post and get 7 days of free access to the full post archives.